About Deposit and Workmanship Warranty Protection

If your installer has ceased to trade then the guidance provided on this page should help, should you encounter any issues.

In accordance with RECC, all members must insure any deposits and further advance (or ‘stage’) payments they take, together with the workmanship warranties they issue, to protect a consumer against an installer ceasing to trade. If you have paid a deposit, or you have had an installation completed and your installer has now ceased to trade leaving you with issues, then this guidance should help.

First you should identify your insurance provider. To do this:

- look through any paperwork provided by your installer to see if you have a valid deposit and/ or workmanship warranty insurance policy;

- look on your MCS certificate to see if it names your insurance provider here;

- contact RECC to see if we are aware of the insurance provider your installer may have used. Please note, RECC does not hold any consumer details and will not be able to tell you if insurance is in place.

Next you should contact your insurance provider to see if you can make a claim.

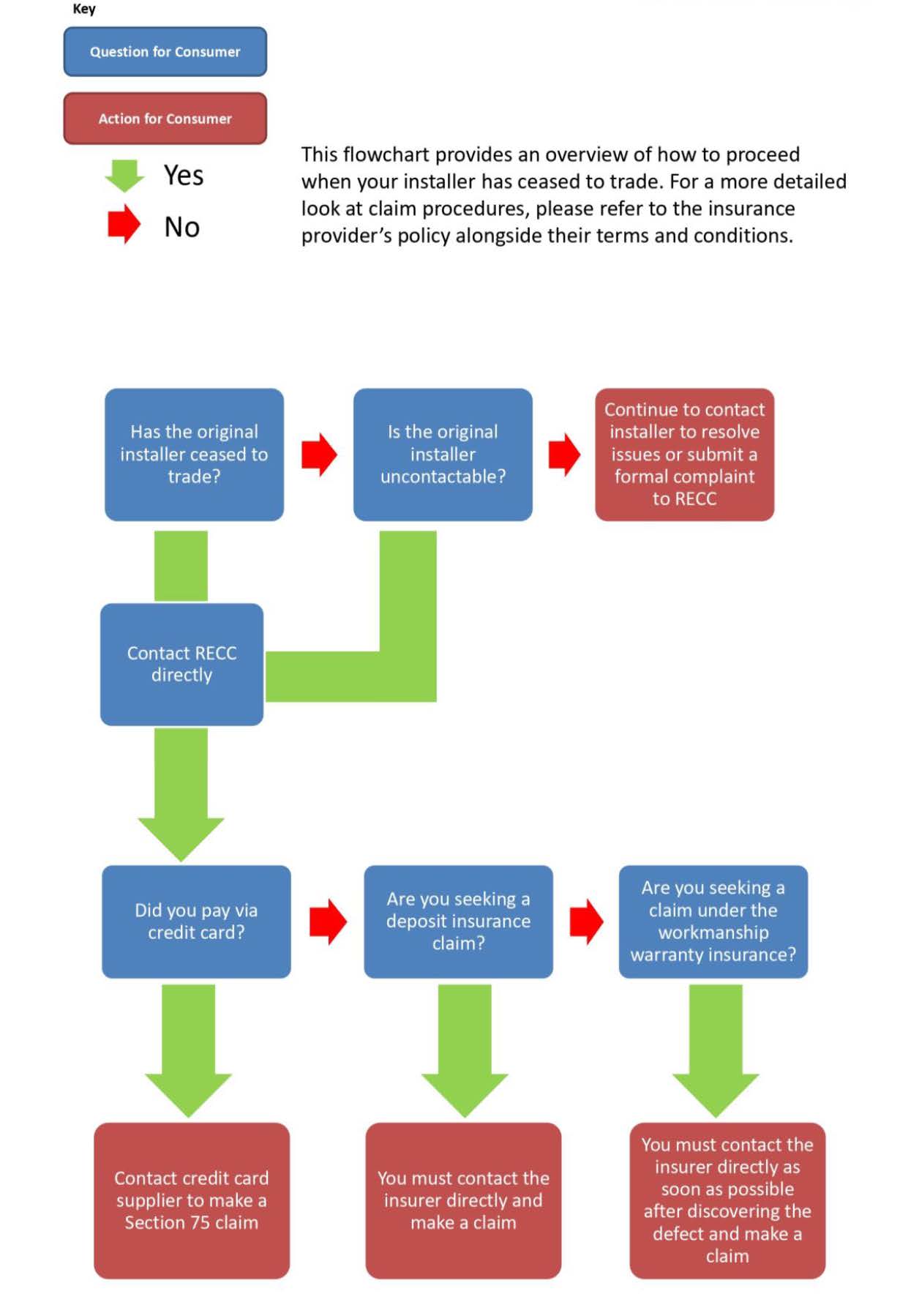

RECC has prepared this 'Insurance Provider's Claims Process Flowchart' for a visual overview of the process. As this flowchart is only a summary, you must consult the relevant insurance provider for more information on how deposits, advance payments and workmanship warranties are protected and how to make a claim.

A list of the main insurance providers RECC is aware of and any important information about their policies and claims processes are shown below.

Please note that the information is correct to the best of RECC’s knowledge. Renewable Energy Assurance Ltd (REAL), the company that administers RECC, is not an insurance company itself. Neither REAL nor RECC derive any benefit, financial or otherwise, from any insurance provider.

Ark Insurance Group

Deposits

Deposit protection is for up to 120 days

Further advanced payments over 25% of the contract value may be insured

How to claim - Consumer normally refunded their deposit

Insurance Backed Guarantees

Offer up to 12 years cover

https://www.arkinsurance.co.uk/

Consumer Protection Association (CPA)

Deposits

Deposit protection is for 120 days or more

How to claim - Insurance provider is responsible for finding a new contractor

Insurance Backed Guarantees

Consumers must register their policy with the insurance provider for it to be effective

Offers 2, 5, and 10 years cover

Defects must be reported within 30 days of discovery

Home Improvement Protection (HIP)

Deposits

Deposit protection is for 90 days

How to claim - Insurance provider is responsible for finding a new contractor

Insurance Backed Guarantees

Offers 2, 5, and 10 years cover

Defects must be reported within 30 days of discovery

Homepro

Information pending

https://www.homepro.com/

Independent Warranty Association (IWA)

Deposits

Deposit protection is for 90 days

How to claim - Insurance provider is responsible for finding a new contractor

Insurance Backed Guarantees

Offers 2, 5, and 10 years cover

Defects must be reported within 30 days of discovery

Peacock Insurance Services

Deposits

Deposit protection is for up to 120 days

How to claim - Varies based on Guarantee and policy terms

Insurance Backed Guarantees

Offer 10 to 12 years cover

Defects must be reported as soon as practically possible

https://www.peacockinsurance.co.uk/

QANW

Deposits

Deposit protection is for 35 days or more

How to claim - Dependant on claim circumstances a consumer can be refunded a deposit or the insurance provider may appoint a new contractor to complete the works

Insurance Backed Guarantees

Offer 2, 5, and 10 years cover

Defects must be reported within 30 days of discovery

Defects that are discovered 6 months prior to a company ceasing to trade can be covered

Qualitymark Protection

Deposits

Deposit protection is for up to 90 days

How to claim - Insurance provider is responsible for finding a new contractor

Insurance Backed Guarantees

Offer 1, 2, and 10 years cover

Defects must be reported within 30 days of discovery

For defects discovered prior to the company ceasing to trade, see guarantee and policy wording